Paisa denominated coins ceased to be legal tender in 2013, leaving the Re. 1/- coin as the minimum legal tender. The Re. 1/- and Rs. 2/- coins were changed to aluminium in 2007. There are two variations of Rs. 2/- coins: most have clouds above the Badshahi Masjid but many do not. The 5, 10, 25 and 50 paise all ceased production in 1996. 2 paise coins were last minted in 1976, with 1 paisa coins ceasing production in 1979. In 1963, 10 and 25 paise coins were introduced, followed by 2 paise the next year.

In 1961, coins for 1, 5 and 10 pice were issued, followed later the same year by 1 paisa, 5 and 10 paise coins. In 1948, coins were introduced in denominations of 1 pice, 1⁄ 2, 1 and 2 annas, 1⁄ 4, 1⁄ 2 and 1 rupee. Numbers are still grouped in thousands ( 123,456,789 rather than 12,34,56,789 as written in India)Ĭommemorative Rs. 20/- coin on the 150th year of Lawrence College Ghora Gali in 2011. In Pakistani English, large values of rupees are counted in thousands lakh (hundred thousands) crore (ten-millions) arab (billion) kharab (hundred billion).

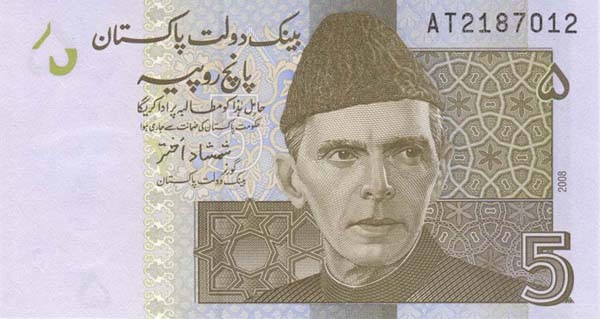

The coins and notes are issued and controlled by the central bank, namely State Bank of Pakistan.

#Pakistani rupee iso

The Pakistani rupee ( Urdu: روپیہ / ALA-LC: Rūpiyah sign: Re (singular) and Rs (plural) ISO code: PKR) is the official currency of Pakistan since 1948. (defunct) Paisa denominated coins ceased to be legal tender in 2013 Treasuries rose sharply, with both at levels last seen in early January.Rs. 20/-, Rs. 100/-, Rs. 500/- and Rs. 1,000/- banknotes Some issues shed more than 3 cents on the dollar and the premium demanded by investors to hold the bonds over safe-haven U.S. Pakistan's international bonds suffered sharp declines.

Speaking at a regular China foreign ministry media briefing on Thursday in Beijing, spokeswoman Mao Ning said China and Pakistan were "all-weather strategic partners and solid friends" and called on all creditors to "act together and play a constructive role in stabilising Pakistan's economy and society." Long-time ally China is the only country that has refinanced $700 million to Islamabad. To try to tackle soaring inflation, shore up its currency and fulfil another IMF demand, Pakistan's central bank announced on Thursday a larger-than-expected 300 bps interest rate hike.īringing forward a meeting that had originally been scheduled for March 16, policymakers lifted the key lending rate to 20% - its highest level since October 1996.īilateral and multilateral external financing are among the other IMF demands, but progress has been slow. The fiscal adjustments demanded by any deal, however, are likely to add to record-high inflation, which hit 31.5% year-on-year in February, analysts say. Pakistan has already taken most of the other prior actions, which included hikes in fuel and energy tariffs, the withdrawal of subsidies in export and power sectors, and generating more revenues through new taxation in a supplementary budget. The IMF's prerequisites are aimed at ensuring Pakistan shrinks its fiscal deficit ahead of its annual budget around June. "Our negotiations with IMF are about to conclude and we expect to sign staff level agreement with IMF by next week," said Finance Minister Ishaq Dar on Twitter - though his comments did little to reassure the markets. If approved by its board, that would release a funding tranche of over $1 billion that has been delayed since late last year over a policy framework. Pakistan's central bank's foreign exchange reserves have fallen to levels barely enough to cover three weeks of imports.Ī move to a market-based currency exchange rate regime is among the actions the IMF wants Pakistan to complete to clear its ninth review. The IMF funding is critical for the South Asian economy, which has been in economic turmoil, to unlock other bilateral and multilateral external financing. "A delay in IMF funding is creating uncertainty in the currency market," said Mohammed Sohail of Topline Securities, a Karachi-based brokerage house.

0 kommentar(er)

0 kommentar(er)